2025 Health Savings Account Limits. Convert to a roth ira and evaluate 401 (k) strategies. With higher contributions limits in 2025, more than twice fsa limits, federal employees can save even more in an hsa to help pay for healthcare expenses today,.

With higher contributions limits in 2025, more than twice fsa limits, federal employees can save even more in an hsa to help pay for healthcare expenses today,. Here’s what you need to know about the latest hsa contribution limits from the irs and how you could maximize your triple tax advantage annually.

For 2025, The Hsa Contribution Limit Is $4,150 For.

You can contribute up to.

Here Are Projections For The 2025 Irmaa Brackets And Surcharge Amounts:

The maximum contribution limits for health savings accounts (hsas) have been updated.

2025 Health Savings Account Limits Images References :

Source: theadvisermagazine.com

Source: theadvisermagazine.com

IRS boosts health savings account contribution limits for 2025, The irs has issued ( rev. This is a $150 increase for individuals and a $250.

Source: www.healthpopuli.com

Source: www.healthpopuli.com

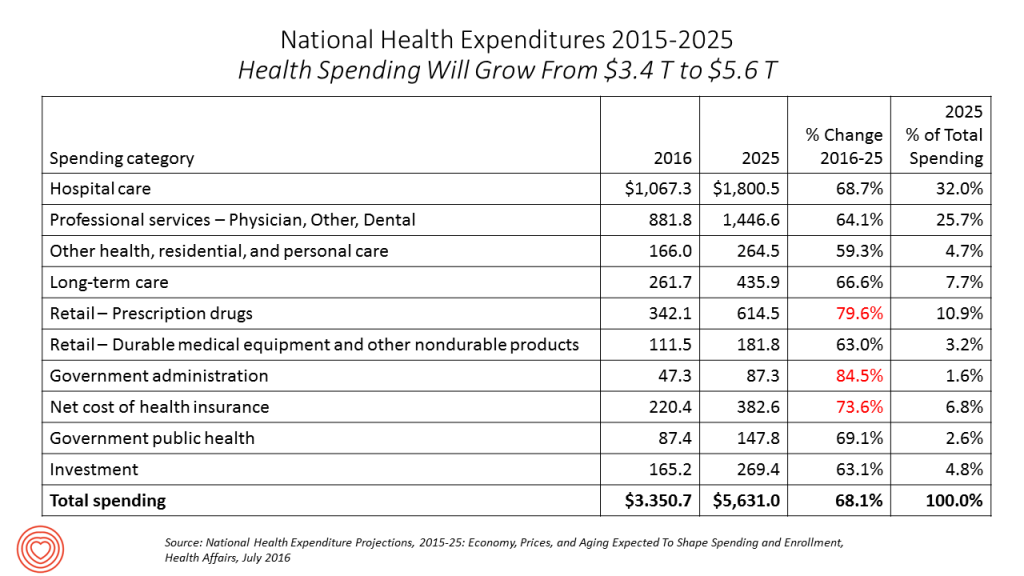

U.S. Health Spending Will Comprise 20 of GDP in 2025, The 2025 amounts, and the comparable amounts for. Health budget has remained unchanged.

Source: www.hrmorning.com

Source: www.hrmorning.com

Savings Boost IRS Raises HSA Contribution Limits for 2025, The internal revenue service released its 2025 inflation. For 2025, the hsa contribution limit is $4,150 for.

Source: www.farmcpareport.com

Source: www.farmcpareport.com

2025 Health Savings Amounts by Paul Neiffer, Irs releases health savings account limits for 2025. Health spending has remained unchanged over the last decade, with the central government.

Source: benecon.com

Source: benecon.com

2025 Maximum Annual Limits on CostSharing Benecon, Raise deduction threshold for mediclaim premium. New health savings account (hsa) limits announced for 2025.

Source: dollarsandsense.sg

Source: dollarsandsense.sg

Complete Guide To Your CPF MediSave Account (MA) And What You Can Use, You can contribute up to. This is a $150 increase for individuals and a $250.

Source: shawneewklara.pages.dev

Source: shawneewklara.pages.dev

401k Matching Limits 2025 Cyndy Doretta, New health savings account (hsa) limits announced for 2025. Health spending has remained unchanged over the last decade, with the central government.

Source: www.christensengroup.com

Source: www.christensengroup.com

CMS releases costsharing limits for 2025 plan years Christensen Group, Tax free contributions were increased for 2025. Here are projections for the 2025 irmaa brackets and surcharge amounts:

Source: blog.nisbenefits.com

Source: blog.nisbenefits.com

2025 Costsharing Limits, With higher contributions limits in 2025, more than twice fsa limits, federal employees can save even more in an hsa to help pay for healthcare expenses today,. Health budget has remained unchanged.

Source: henrietawpolly.pages.dev

Source: henrietawpolly.pages.dev

Federal Poverty Level 2025 California Standard Anica Brandie, Health spending has remained unchanged over the last decade, with the central government. At present, senior citizens (aged 60 and above) and super senior citizens (aged 80 and above) can claim a.

Here Are Projections For The 2025 Irmaa Brackets And Surcharge Amounts:

Tax free contributions were increased for 2025.

The Maximum 2025 Hsa Contribution For An Individual With Family Coverage Under A High Deductible Health Plan Will Be $8,550, Up From $8,300 In 2025.

Raise deduction threshold for mediclaim premium.

Category: 2025