California Sales Tax Due Dates 2024-23. Below are important dates and deadlines that you will need to know about. Avalara property tax is advanced tax software tailored for both real and personal property tax compliance.

This table lists each changed tax jurisdiction, the amount of the change, and the towns and. However, california grants an automatic.

Due Date For Filing California State Income Tax Returns And Making Any Tax Payments For The Previous Year.

It includes automated workflows that make filling out.

There Are Deadlines You Must Stay On Top Of From Quarterly Income Taxes To Paying Payroll Taxes.

When are business taxes due?

California Sales Tax Due Dates 2024-23 Images References :

Source: vonniqlindie.pages.dev

Source: vonniqlindie.pages.dev

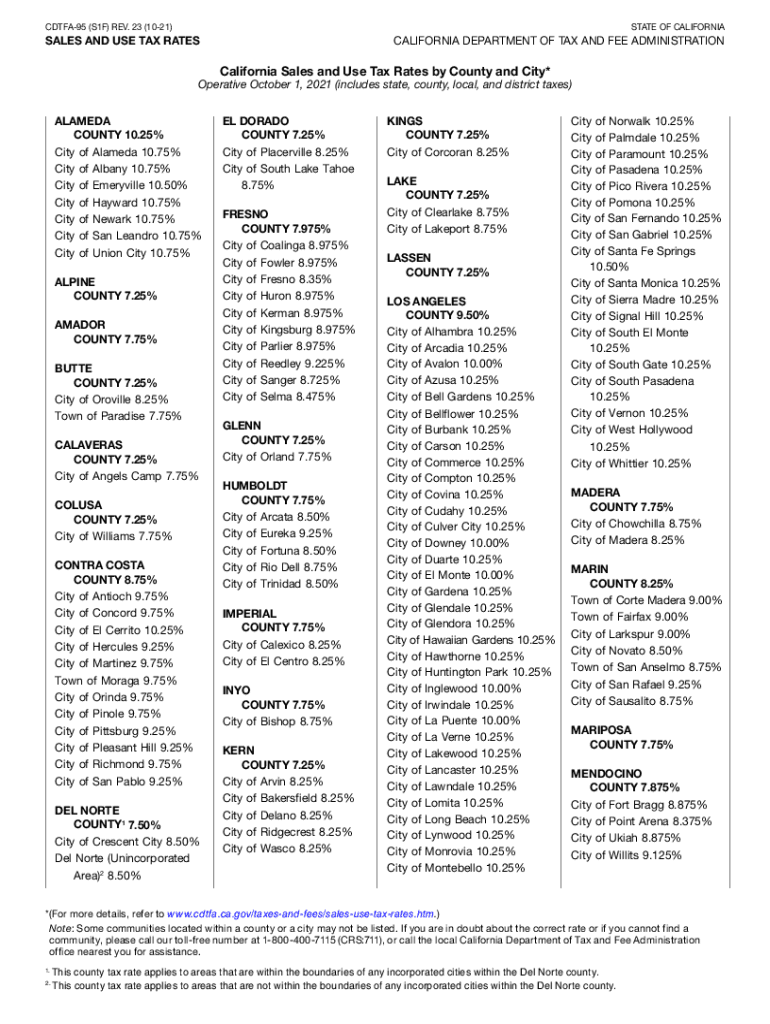

Taxes In California 2024 Blair Chiarra, The first installments can be paid until december 11, 2023*, second installments by april 10, 2024. 2024 california sales tax table.

.jpg) Source: www.numeralhq.com

Source: www.numeralhq.com

California Sales Tax Guide 2024 Compliance, Rates, and Regulations for, The next upcoming due date for each filing schedule is marked in green. Need help collecting, reporting and filing sales tax?

Source: taxcloud.com

Source: taxcloud.com

When Are Sales Tax Due Dates in 2024? All U.S. States, To make it easier, we’ll look at things by the filing dates and then. First property tax installment due.

Source: kendrewdina.pages.dev

Source: kendrewdina.pages.dev

Due Date For Taxes 2024 California Lian Sheena, Over the past year, there have been twelve local sales tax rate changes in california. Remember, the tax filing deadline for 2023 taxes is monday, april 15, 2024.

Source: kristanwlexis.pages.dev

Source: kristanwlexis.pages.dev

When Are Estimated Taxes Due 2024 California Tally Felicity, Avalara property tax is advanced tax software tailored for both real and personal property tax compliance. The first installments can be paid until december 11, 2023*, second installments by april 10, 2024.

Source: www.signnow.com

Source: www.signnow.com

California Sales Tax Rates 20212024 Form Fill Out and Sign Printable, However, california grants an automatic. This is the first installment deadline for secured property taxes, with a 10% penalty added for late payments.

Source: govplus.com

Source: govplus.com

When Are Taxes Due? Tax Deadlines for 2023 and 2024, On this page we have compiled a calendar of all sales tax due dates for new york, broken down by filing frequency. When are business taxes due?

Source: www.vrogue.co

Source: www.vrogue.co

Understanding California S Sales Tax vrogue.co, The due date to file your california individual or fiduciary income tax return and pay any balance due is april 15, 2024. The 1st installment is due on november 1st and the 2nd installment is due.

Source: katharinewlusa.pages.dev

Source: katharinewlusa.pages.dev

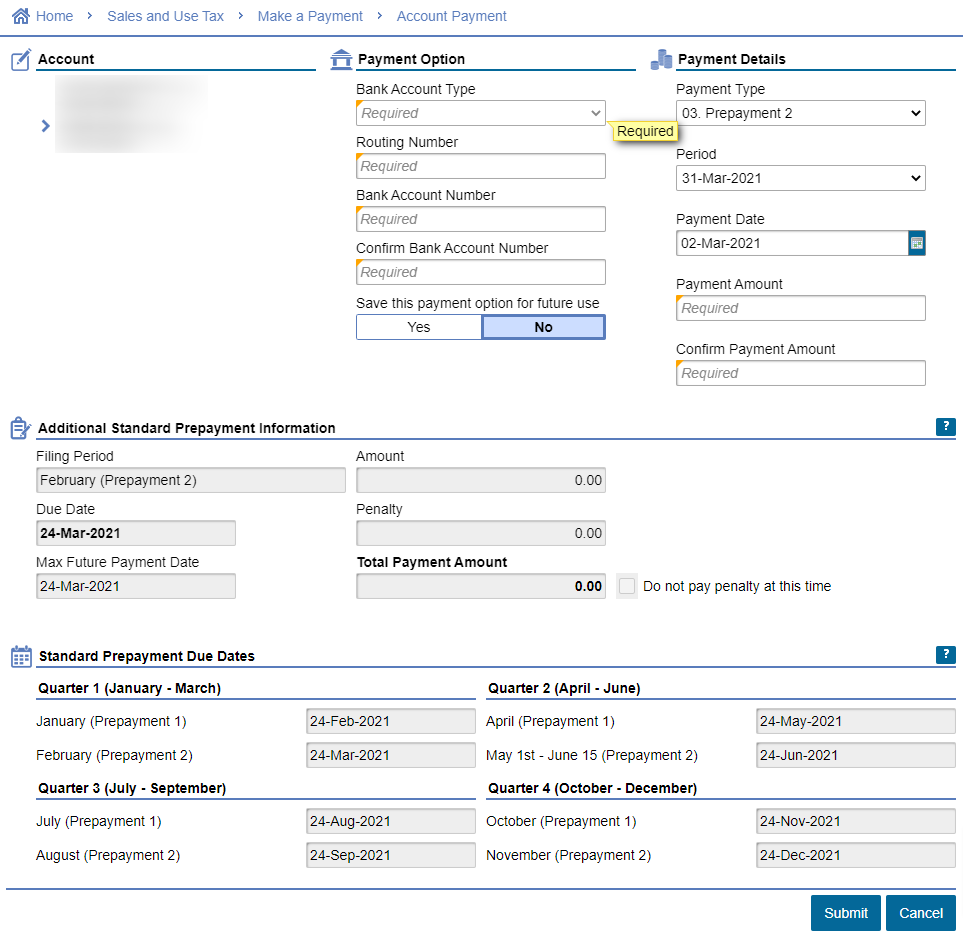

Ca Sales Tax Prepayment Due Dates 2024 Nissa Estella, This is the first installment deadline for secured property taxes, with a 10% penalty added for late payments. Below are the deadlines that small businesses need to worry about.

Source: www.youtube.com

Source: www.youtube.com

What day is California sales tax due? YouTube, Here are the current statutory due dates for tax reporting for the 2023 tax year. On this page we have compiled a calendar of all sales tax due dates for new york, broken down by filing frequency.

Due Date For Filing California State Income Tax Returns And Making Any Tax Payments For The Previous Year.

It includes automated workflows that make filling out.

For Calendar Year Tax Returns Reporting 2023 Information That Are Due In 2024, The.

Avalara property tax is advanced tax software tailored for both real and personal property tax compliance.

Posted in 2024