Irs Extension Deadline 2024 Form 2024. The irs will give taxpayers an automatic extension if they file form 4868. You can file for a tax extension in 2024 by submitting form 4868 to the irs on or before the april 15, 2024 tax deadline.

You can continue to use 2022 and 2021. Those who file irs form 4868 on or before april 15, 2024, to request a tax.

Irs Extension Deadline 2024 Form 2024 Images References :

Source: catharinewemlyn.pages.dev

Source: catharinewemlyn.pages.dev

Irs 2024 Tax Extension Deadline Essie Livvie, The irs relief is for those in areas.

Source: gnniyrosmunda.pages.dev

Source: gnniyrosmunda.pages.dev

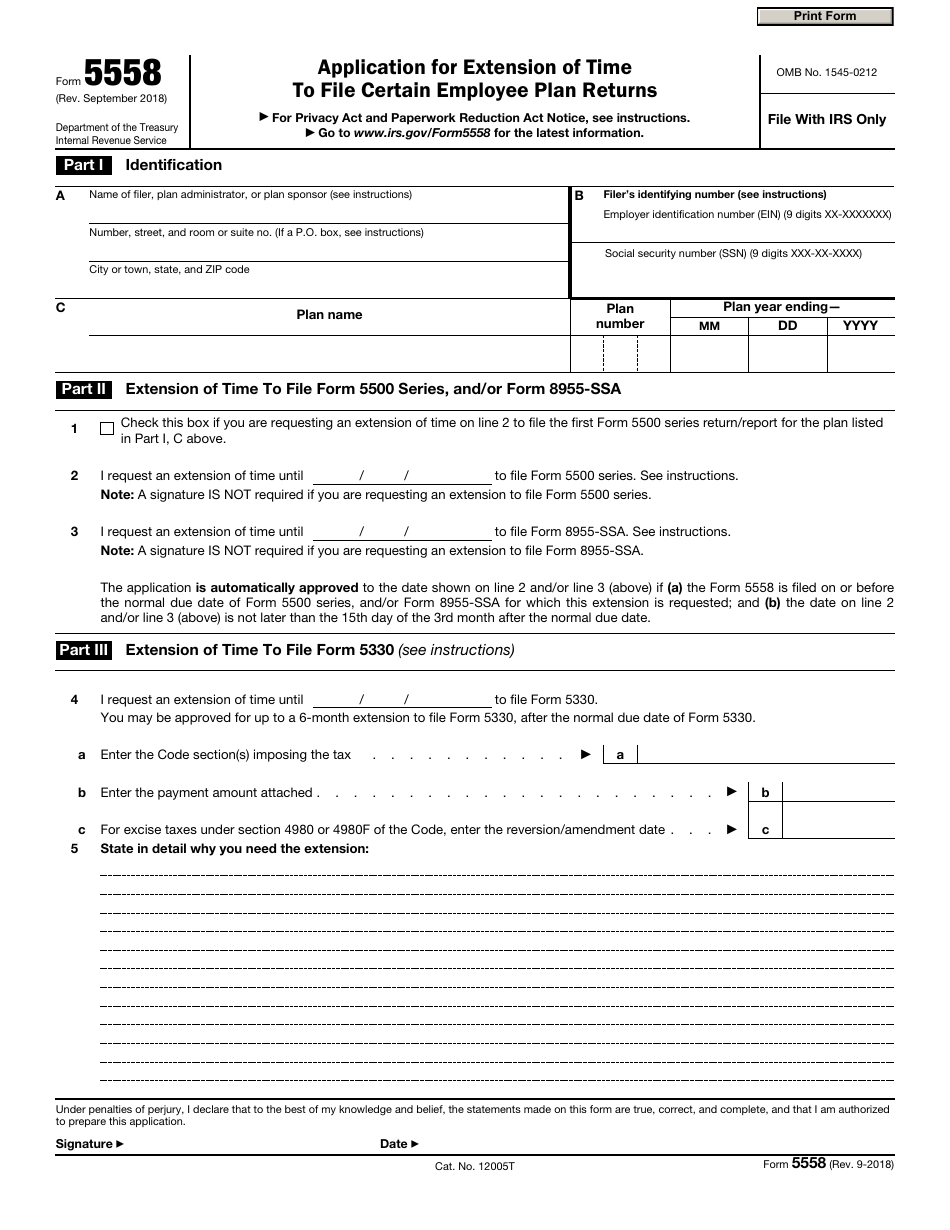

Irs Extension Deadline 2024 Form 2024 Flora Michelina, You have 5 calendar days after the initial date when you transmit a form 7004 or form 8868 extension electronic file to receive approval on a rejected.

Source: gnniyrosmunda.pages.dev

Source: gnniyrosmunda.pages.dev

Irs Extension Deadline 2024 Form 2024 Flora Michelina, You can continue to use 2022 and 2021.

Source: gertbgabriela.pages.dev

Source: gertbgabriela.pages.dev

Irs Extension Deadline 2024 Form 2024 Hattie Romona, You can file for a tax extension in 2024 by submitting form 4868 to the irs on or before the april 15, 2024 tax deadline.

Source: gnniyrosmunda.pages.dev

Source: gnniyrosmunda.pages.dev

Irs Extension Deadline 2024 Form 2024 Flora Michelina, Does the 2024 tax extension deadline apply to me?

Source: gnniyrosmunda.pages.dev

Source: gnniyrosmunda.pages.dev

Irs Extension Deadline 2024 Form 2024 Flora Michelina, If you need more time to file your taxes, you can request an extension through october 15.

Source: geraldawlori.pages.dev

Source: geraldawlori.pages.dev

Irs Tax Filing Extension Deadline 2024 Greer Shanda, When to file | internal revenue service.

Source: suzannewmarjy.pages.dev

Source: suzannewmarjy.pages.dev

Irs Payment Extension 2024 Henrie Steffane, You can file for a tax extension in 2024 by submitting form 4868 to the irs on or before the april 15, 2024 tax deadline.

Source: sonniqmarley.pages.dev

Source: sonniqmarley.pages.dev

Irs Tax Filing Extension Deadline 2024 Max Lisbeth, Washington — the internal revenue service today reminded taxpayers the deadline to submit their third quarter estimated tax payment is sept.

Source: francescawira.pages.dev

Source: francescawira.pages.dev

Irs Tax Filing Extension Deadline 2024 Dodie Lyndel, You can continue to use 2022 and 2021.

Posted in 2024